wyoming tax rate for corporations

Personal rates which generally vary. A Wyoming LLC also has to file an annual report with the secretary of state.

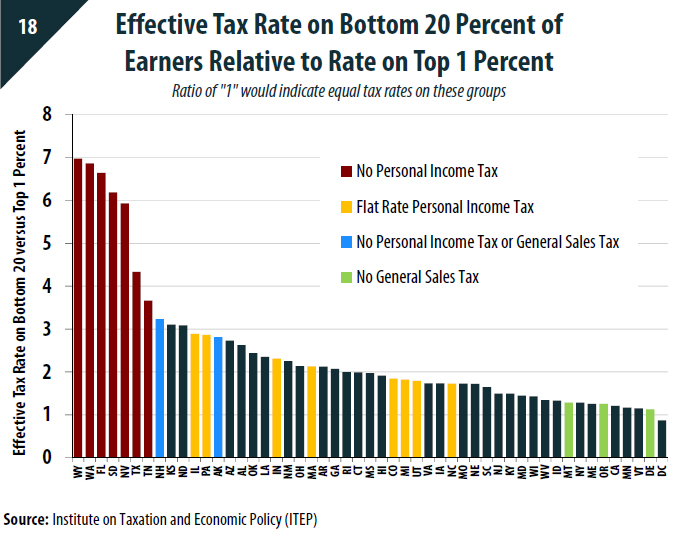

Individual Income Tax Structures In Selected States The Civic Federation

This will cost you 325 for a corporation or an LLC.

. Wyoming also does not have a corporate income tax. The current corporate tax rate federal is 21 thanks to the Tax Cuts and Jobs Act of 2017. Wyoming has no corporate income tax at the state level making it an attractive.

Because your Wyoming corporation income flows through to your personal tax return you must pay self-employment tax also known as FICA Social Security or Medicare tax on your. Wyoming has been consistently ranked as the most tax friendly state in the union. The state of Wyoming charges a 4 sales tax.

The wyoming state sales tax rate is 4 and the average wy sales tax. We recommend you form a Wyoming LLC or incorporate in Wyoming. The annual report fee is based on assets located in Wyoming.

An S-Corp can be taxed more or less but avoids double taxation. Wyoming charges a sales and use tax of 4 for which you will need a license to collect if you sell physical goods andor provide certain types of services. Wyomings Sales and Use Tax.

Wyoming is the least taxed State in America if you figure there is no personal or corporate income tax. Personal Service Corporations may be taxed at a different rate. An S-Corp is not taxed at the same rate as a C-Corporation which is 21 at the time of this writing.

Theres good reason for that. Effective July 1 2021 there will be an increase from 12 to 20 in the collection fee on SalesUse Tax Accounts that have been referred or will be referred to an external. A 7 percent corporate income tax on these operations still means that the state has a very low tax burden but if it makes some of these chains locations outside of Cheyenne.

Additionally counties may charge up to an additional. Ad The tax landscape is transforming. Detailed Wyoming state income tax rates and brackets are available on this page.

What is the Wyoming corporate net income tax rate. Wyoming does not place a tax on retirement income. Security and flexibility with Access to Funds No Opening or Maintenance Fees.

The Wyoming income tax has one tax bracket with a maximum marginal income tax of 000 as of 2022. Wyoming has a 400 percent state sales tax a max local sales tax rate of 200 percent and an average combined state and local sales tax. Up to 25 cash back Corporate rates which most often are flat regardless of the amount of income generally range from roughly 4 to 10.

We include everything you need for the LLC. The sales tax is about 542 which. The tax is either 60 minimum or 0002 per dollar of.

A Better Wyoming Everything You Know About Wyoming Taxes Is Wrong Itep

Wyoming Trusts Protected By Strong Privacy Laws Draw Global Elite Washington Post

Corporate Income Tax Rates By State Discover The Rates For All 50 States

The Most Tax Friendly U S State For Retirees Isn T What You D Guess And Neither Is The Least Tax Friendly Marketwatch

A Corporate Income Tax In Wyoming Legislation That Would Enact It Is Moving Forward

Wyoming Sales Tax Rate Rates Calculator Avalara

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

Wyoming Income Tax Calculator Smartasset

Laying The Foundation Funeral Home Consulting

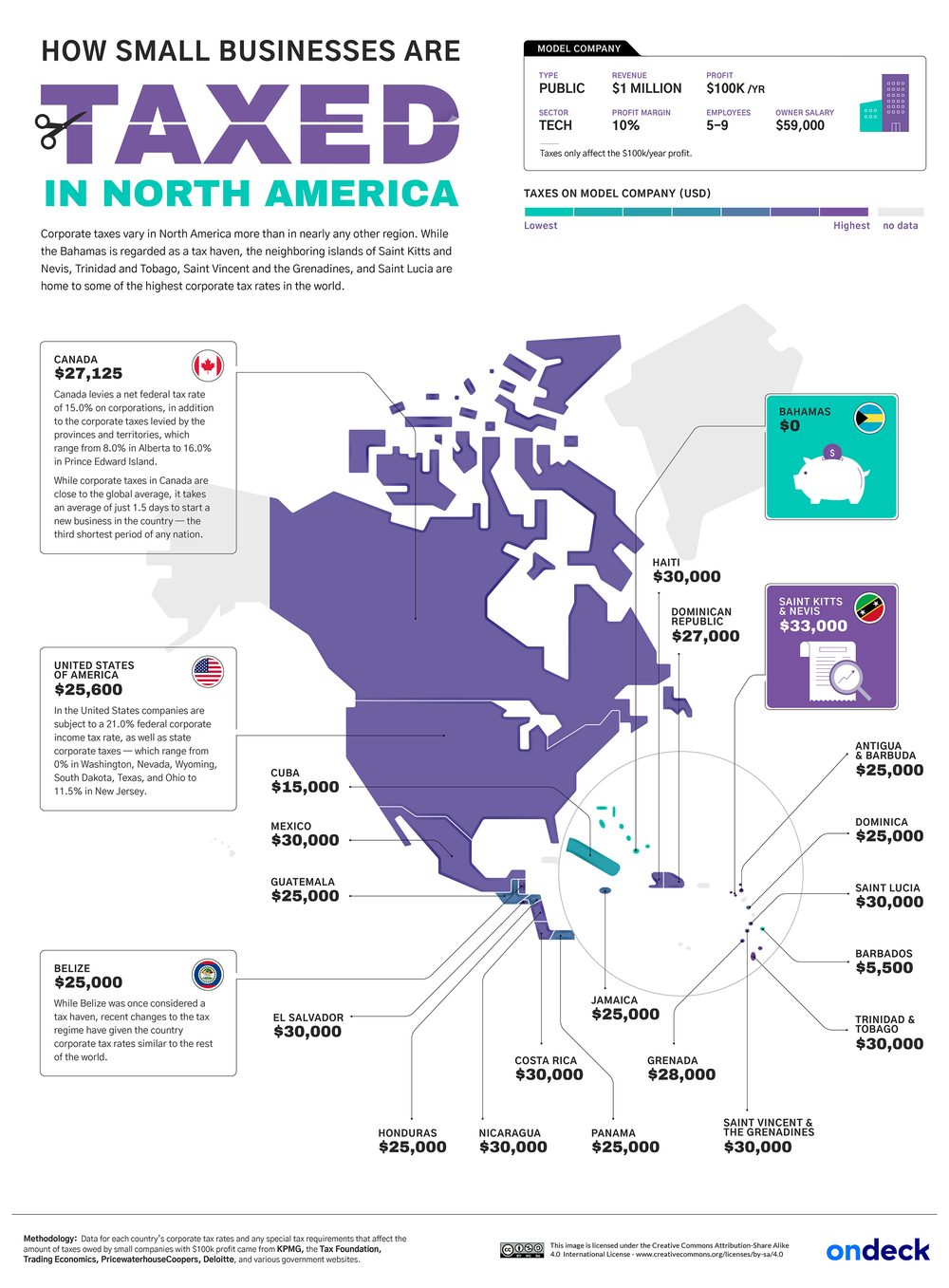

Taxes On Small Businesses Across The Globe Mapped See Where Rates Are High Low And Nonexistent

Small Business Tax Rate 2021 Guide For Business Owners

Corporate Tax Rates By State Where To Start A Business

Corporate Income Taxes Urban Institute

A New Minnesota Law Is Saving Certain Kinds Of Businesses A Boatload In Federal Income Taxes Minnpost

Wyoming Changes Sales Tax Rules For Remote Sellers

State Sales Tax Rates 2022 Avalara

Wyoming Named 1 State For Doing Business Jackson Hole Real Estate Mercedes Huff